In recent years, the term “tariff” has become almost synonymous with economic friction and political posturing. Yet, at its core, tariffs possess the formidable power to influence global innovation, reshape supply chains, and redefine national economic trajectories. When policymakers impose tariffs, it is not merely an act of taxation; it is a strategic move that can either catalyze domestic growth or stifle technological advancement. The latest wave of tariffs, exemplified by the August 2025 executive order from the United States, exemplifies this dual capacity to both protect and threaten economic progress.

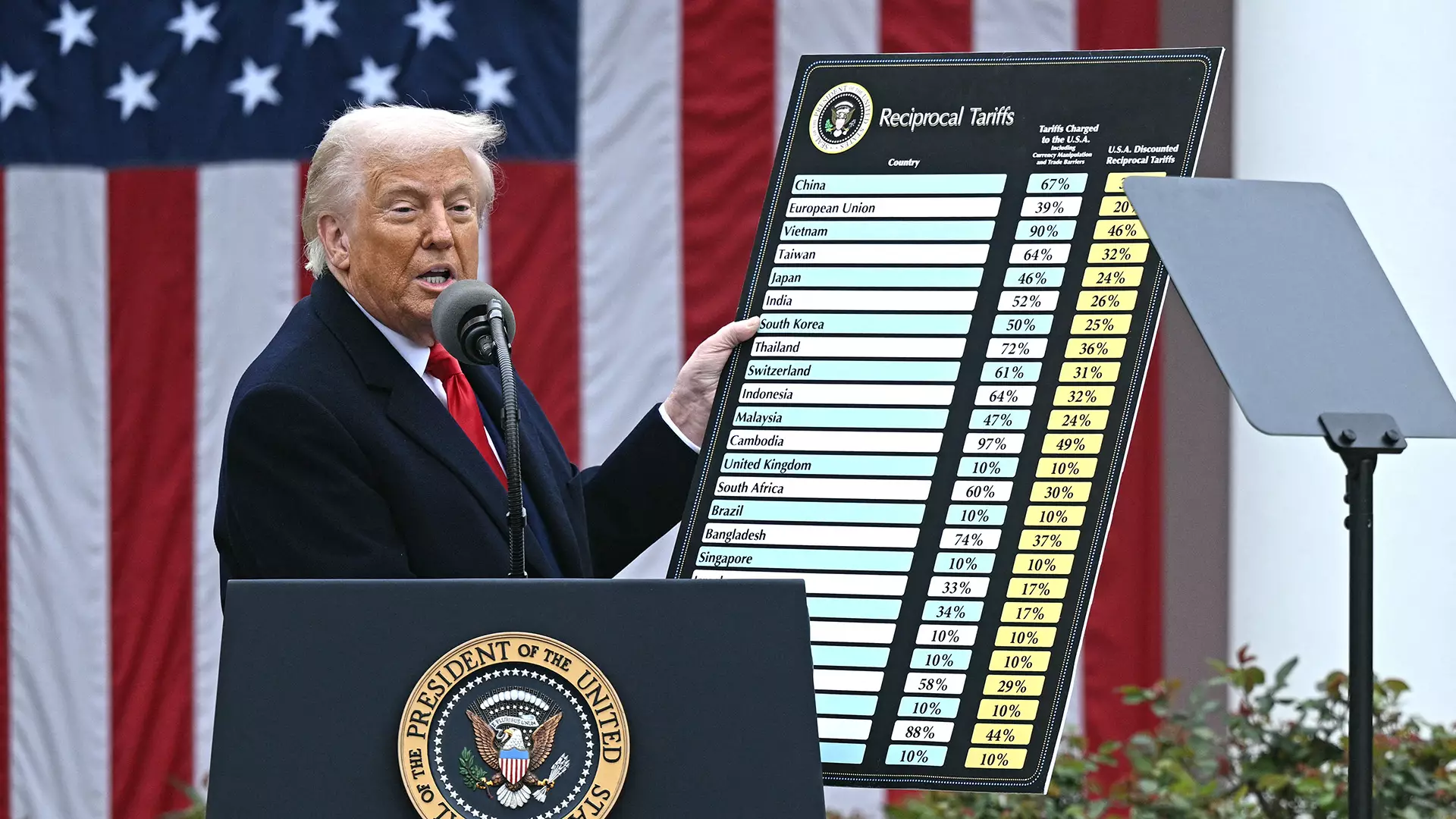

President Donald Trump’s administration, citing national security concerns, announced reciprocal tariffs targeting a broad array of countries. These measures, justified by perceived trade imbalances and lack of fairness, notably exempted certain vital sectors such as pharmaceuticals and semiconductors in Malaysia. However, Taiwan—a pivotal producer of high-quality semiconductors—remains under the shadow of uncertainty, with the prospect of tariffs looming. This demonstrates how geopolitical considerations and economic interests intertwine in the modern era, with technology being both a battleground and a catalyst for innovation.

The executive order, referencing earlier policies adopted in April 2025, frames tariffs as a response to what it perceives as an unprecedented threat to America’s economy and security. It sparks a debate about whether such protective measures truly serve national interests or merely disrupt the global supply ecosystem. The targeted tariffs, especially on trans-shipped goods from high-tariff to low-tariff jurisdictions, threaten the flow of vital components, risking delays and increased costs across industries.

Impacted Industries: Innovation in the Crossfire

The ripple effects of these tariffs extend beyond immediate trade balances; they threaten to destabilize the delicate ecosystem of global manufacturing, particularly in semiconductor and PC hardware sectors. Companies like TSMC and Samsung, which are investing heavily in local production facilities in the United States, are a testament to strategic adaptation. Yet, despite these investments, the sheer scale of global demand—particularly in high-tech sectors like gaming, AI, and cloud computing—makes complete domestic fulfillment impossible without significant cost increases.

For the semiconductor industry, tariffs present a paradox. While they aim to insulate domestic production, they also risk reducing the competitiveness of American firms that rely on foreign imports for advanced chips. The uncertainty caused by these tariffs could push innovators to seek alternative markets or accelerate efforts to develop even more autonomous manufacturing solutions. Nevertheless, without clear exemptions for critical components, the industry might face higher costs, slowed innovation, and a less responsive supply chain, ultimately curbing the pace of technological progress.

The gaming industry, and by extension its hardware sector, often finds itself caught in this web of geopolitical tension. Rising tariffs translate into increased costs for parts, from graphics cards to CPUs, potentially throttling innovation and leading to higher consumer prices. This scenario underscores an uncomfortable truth: protectionism, if mishandled, can hinder the very innovation it seeks to bolster by creating barriers that slow down technological development and deployment.

The Broader Economic and Geopolitical Implications

Beyond immediate industry impacts, tariffs serve as a strategic tool—either as a show of economic muscle or a catalyst for diplomatic negotiations. In the case of Taiwan, the provisional nature of tariffs on semiconductors reflects ongoing geopolitical negotiations, with the potential for exemptions that could shift market dynamics. The act of imposing tariffs is ultimately a statement about economic sovereignty but also risks escalating into broader conflicts that could harm global stability.

American companies are caught between rising operational costs and the desire to maintain technological superiority. While investments in local manufacturing, such as TSMC’s Arizona plants, demonstrate resilience and foresight, they are not instant solutions. The transition of supply chains takes time, and during that period, the global tech ecosystem faces increased volatility. As a result, consumers and industries must prepare for a future where innovation is increasingly influenced by political decisions rather than purely market forces.

And finally, the political narrative surrounding tariffs influences more than just economics; it shapes perceptions of global leadership, sovereignty, and technological independence. These moves are imbued with a mix of protectionist instincts and strategic ambitions—yet, ultimately, they threaten to complicate, rather than accelerate, the path toward technological breakthroughs that define the modern age. A delicate balance must be struck—one that fosters innovation and global cooperation without allowing geopolitical disputes to hinder progress.