Intel has found itself enmeshed in an ongoing narrative centered around its foundry business, a vital segment that has captured divergent opinions, especially among its former executives. This discussion gains urgency in light of the company’s financial setbacks, which have led some to propose the notion of disentangling the foundry from Intel’s broader operations. Recent comments from John Pitzer, Intel’s vice president of corporate planning and investor relations, have sparked fresh debates, revealing a still significant reliance on TSMC, one of the leading semiconductor companies in the world. The intricacies of this relationship highlight the impact of external partnerships on corporate strategies in high-stakes industries like tech.

Strategic Reconsiderations Amid Shifting Goals

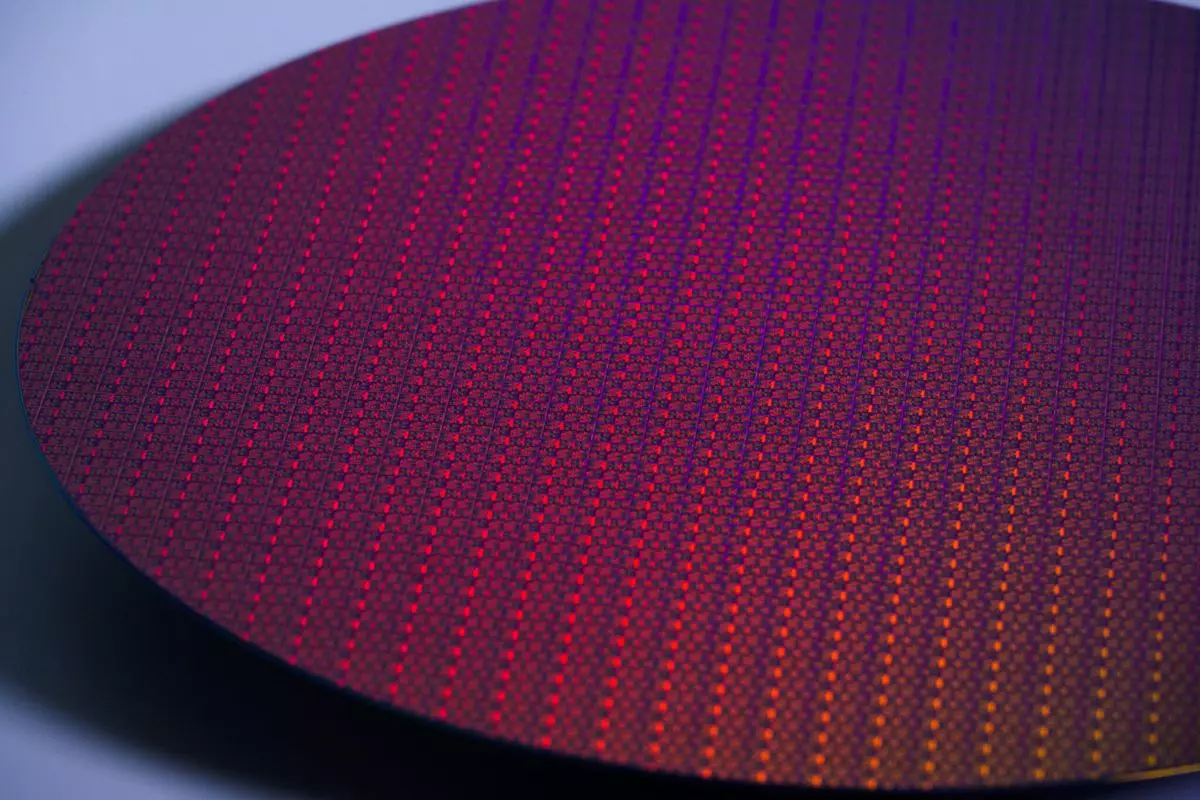

During a technology conference, Pitzer candidly shared Intel’s recalibrated strategy, indicating that 30% of its wafers would continue to be sourced from TSMC—a shift from previous ambitions to eliminate outsourcing entirely. The decision not only brings to light Intel’s ongoing struggles but underscores the complexity of the semiconductor landscape. As Pitzer mentioned, TSMC is “a great supplier,” and having this external factor injects healthy competition into the mix. This partnership, while seemingly a compromise, raises questions about Intel’s competitive edge in an industry that thrives on innovation and cost efficiency. The larger issue here is whether relying on another company for something as fundamental as chip production inherently weakens Intel’s position in the market.

Technology and Competition: The Ripple Effect

Intel’s reliance on TSMC not only affects its market standing but also its profit margins. Outsourcing wafer production to TSMC implies that Intel is incurring costs that could have been alleviated by in-house manufacturing. As the tech giant aims to produce its upcoming Panther Lake mobile CPUs using its much-anticipated 18A process node, the reality is stark: significant portions of its Arrow Lake and Lunar Lake series processors still depend on TSMC’s advanced silicon technology. This duality paints a picture where Intel must navigate the delicate balance between utilizing external resources and pushing for self-sufficiency. Crucially, the company’s repeated declarations of maintaining this level of dependency year after year raises eyebrows about its ability to adapt quickly in a fast-evolving industry.

Leadership Challenges and Strategic Drift

The leadership turmoil following the departure of ex-CEO Pat Gelsinger has certainly added layers of complexity to Intel’s strategic outlook. With interim executives like Dave Zinsner and Michelle Johnston Holthaus adapting to the helm, a clear forward trajectory remains obscured. Gelsinger had previously expressed hopes of reducing TSMC dependency to 20%, yet the current state belies this aspiration. This inconsistency portrays a company in a limbo, entangled in an internal struggle to realign its vision and operational goals during what ideally should be a decisive moment in its history. The uncertainty surrounding leadership decisions can often translate to uncertainty in strategic execution, which may concern investors and stakeholders keen on innovation and market recovery.

The Future: Collaboration or Consolidation?

As the industry anticipates Intel’s next moves amid its ongoing financial and operational challenges, speculation surrounding the possible acquisition of Intel’s foundries by TSMC or even Broadcom looms large. This possibility doesn’t merely reflect the unique intricacies of partnerships in tech but also signifies the evolving power dynamics in chip manufacturing. Will Intel continue to inch closer to TSMC, or will the desire for autonomy reign supreme? The cacophony of opinions surrounding these potential changes is indicative of the growing stakes involved—the outcome could redefine power relations in semiconductor production.

In a world where silicon is the essence of technology, Intel finds itself at a critical juncture. How it navigates the realm of collaboration and independence will undoubtedly affect its standing within the industry and influence the technological landscape for years to come. The clock is ticking for Intel, and the decisions made today will undoubtedly shape the narrative of tomorrow.