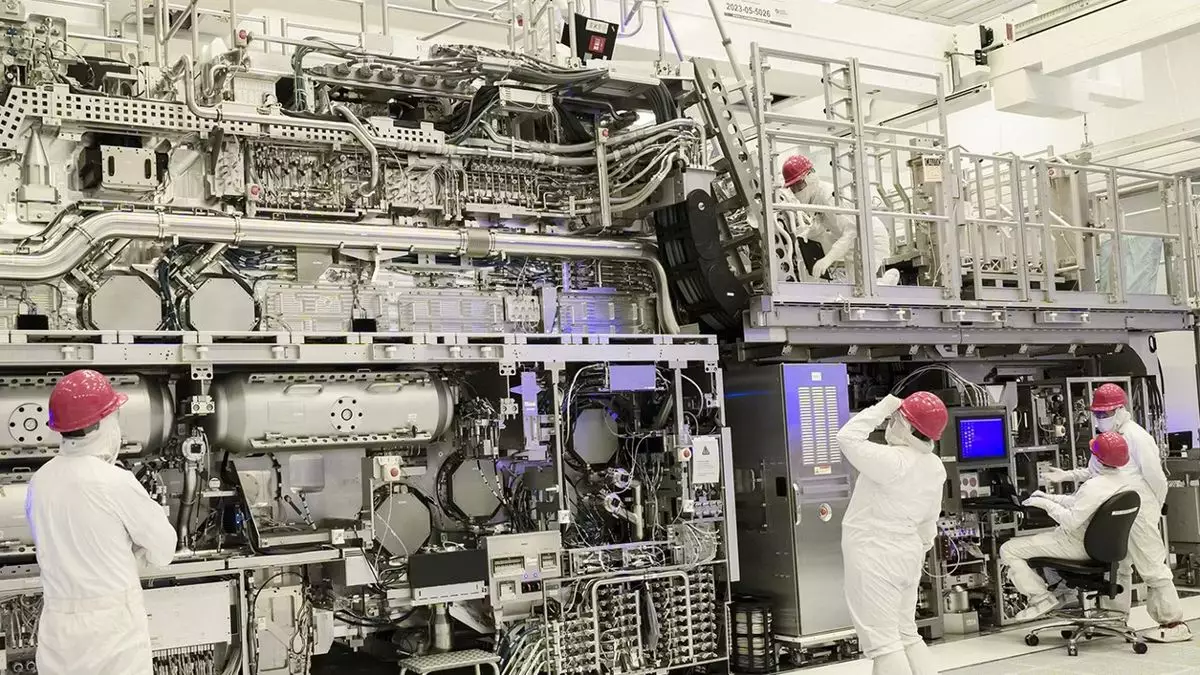

Intel has recently launched a dedicated web portal promoting its much-anticipated 18A chip production node, proclaiming that “Intel 18A is now ready.” But what significance does this have for the PC market, and why should consumers and tech enthusiasts pay close attention? As the chipmaker attempts to reclaim its leadership position amid fierce competition, the timeline and confident messaging surrounding Intel 18A need careful examination.

The Future of Laptops: Panther Lake and Beyond

Intel’s upcoming Panther Lake chip is set to utilize the 18A node, although it won’t be mass-produced until late 2025. This extended timeline suggests that despite the optimistic messaging from Intel, the company is still navigating considerable engineering challenges. The subsequent rollout of 18A-powered laptops is projected for early 2026, meaning that the immediate implications of the launch may not affect the consumer market until then. Such delays raise questions about the reliability of Intel’s timelines and whether their roadmap can actually meet consumer expectations.

The company has also announced the Nova Lake desktop CPU, but similar to Panther Lake, it is slated to release in 2026. The promised performance advantages touted by the 18A node will either have to withstand scrutiny over time or face the risk of losing potential customers to competitors like AMD or TSMC, who are not experiencing similar delays.

Intel’s Strategic Shift: Foundry Services and Market Positioning

A significant aspect of the new 18A announcement is the underlying target towards customers of its foundry services, which is increasingly important for Intel as it seeks to diversify its revenue streams. The messaging on its website indicates that “Intel 18A is now ready for customer projects,” suggesting that external partnerships are a key focus. Could this, however, be more of a marketing initiative than a sign of genuine readiness? The timeline for tape-outs in early 2025 suggests that while the node may be prepared for third-party collaborations, Intel’s internal capabilities are still lagging behind.

An example of this reluctance to fully commit is Intel’s Clearwater Forest server CPU, previously anticipated for 2025, now pushed back to mid-2026. This does not inspire confidence in Intel’s claims of 18A viability as a new standard in chip manufacturing.

Intel’s ambitious “five nodes in four years” (5N4Y) initiative includes several rapidly-accelerating technologies. However, upon inspection, one might conclude that many of these so-called ‘new’ nodes are largely variations on older technology. For instance, Intel 7 essentially represents an iteration of a previous 10nm technology, and Intel 4 notably rebrands earlier 7nm frameworks. The declarations surrounding Intel 20A may ultimately fade away entirely, leaving Intel to navigate a challenging landscape with significantly fewer fresh offerings than originally planned.

While the bold posturing around 18A may excite industry stakeholders, the reality is that only two nodes from this plan—Intel 4 and 18A—can genuinely be classified as new. The ongoing skepticism raises concerns: Can Intel produce competitive products that actually leverage these new nodes?

Performance Claims: Separating Signal from Noise

Intel makes several noteworthy claims about the capabilities of the 18A node, including enhancements in performance efficiency, chip density, and the groundbreaking introduction of PowerVia technology. The promise of 15% better performance per watt and notably improved chip density implies that if these enhancements pan out, Intel could reclaim some ground from TSMC, which currently holds a strong position in the market.

However, extreme caution is warranted. While TSMC’s N2 node offers superior logic gate density, Intel’s claims that 18A matches TSMC’s N2 in SRAM density could be misleading until validated under operational conditions. This highlights the crucial need for rigorous benchmarks as the industry adopts and integrates these new technologies.

The trajectory following the launch of 18A will be essential not only for Intel’s recovery but also for the overall competitiveness within the semiconductor industry. With rising chip prices attributable to supply chain constraints, a successful 18A rollout could counterbalance these costs by injecting competition back into the consumer PC sector. As Intel’s former CEO Pat Gelsinger noted, “betting the company” on 18A reflects the high stakes involved.

Amid a climate that is increasingly hostile to any single vendor’s dominance—with TSMC leading the charge—the importance of having alternatives grows ever clearer. Intel is acutely aware that its anticipated turnaround hinges on its new production nodes meeting or exceeding performance benchmarks.

While Intel’s 18A node brings promises of technological evolution, the realities of its implementation timeline, performance validation, and market competition necessitate ongoing scrutiny. As we await more concrete results, a cautious optimism may be the best approach for both Intel and its consumers.