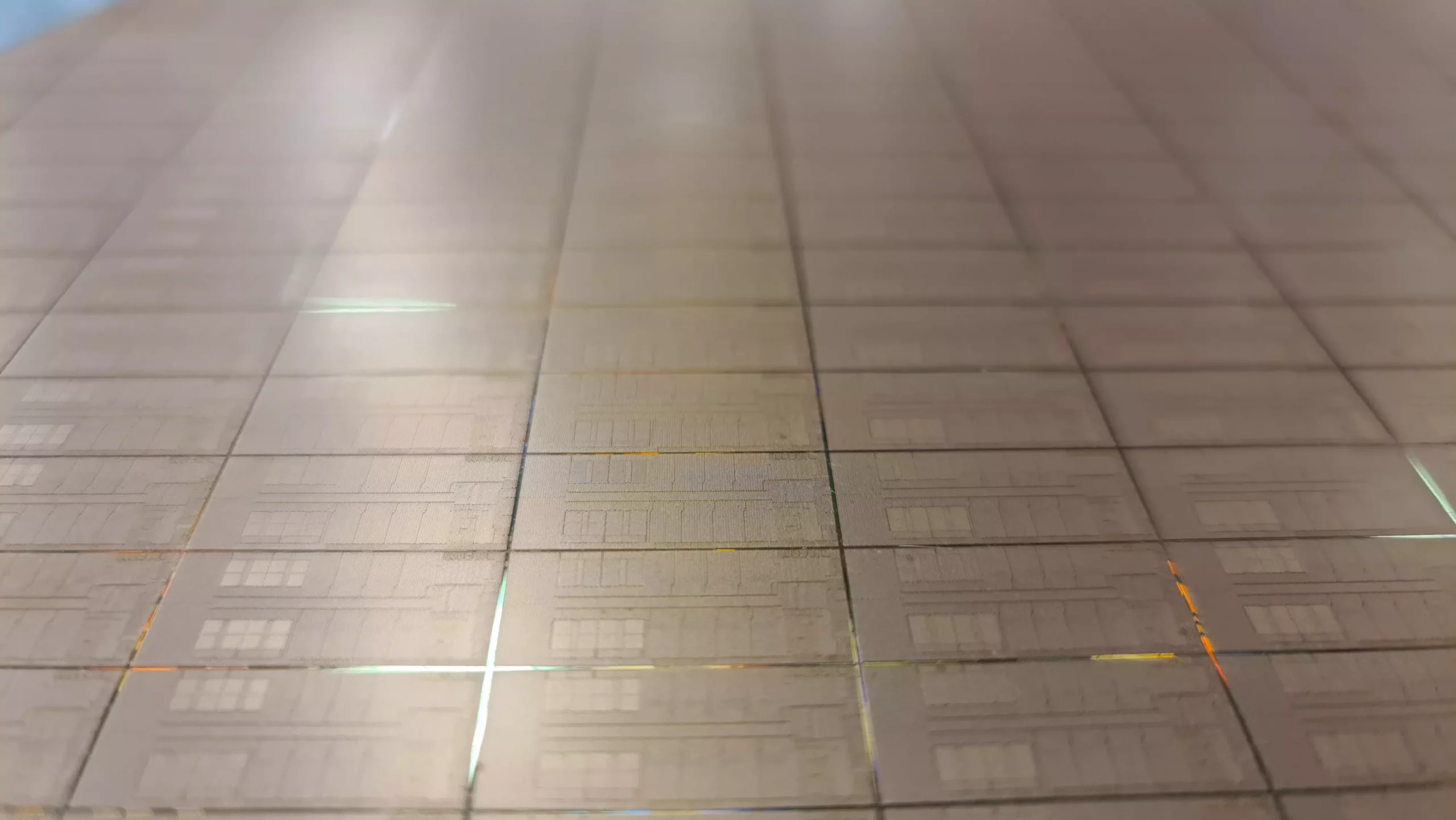

The Intel Corporation, a titan in the semiconductor industry, has made a significant maneuver by divesting 51% of its stake in Altera, a company famed for its prowess in programmable logic devices, to the private equity firm Silver Lake. This transaction marks a strategic pivot for Intel, which had acquired Altera in 2015 for a hefty sum of $16.7 billion. The deal, now valued at $8.75 billion, casts a spotlight on the shifting landscape of tech investments and the inexorable march of innovation within the semiconductor space.

The partnership between Intel and Altera was a marriage of necessity, driven by mutual technology goals that spanned several years. Prior to Intel’s acquisition, the two companies collaborated on various projects, hinting at a historical synergy that bore fruit at critical junctures. However, the evolution of the tech industry often necessitates strategic recalibrations, and Intel’s sale is a palpable sign of its intent to concentrate on its core operations. This decision begs the question: has Intel concluded that managing Altera as a subsidiary diverts focus and resources from their primary goals?

Valuation Versus Reality: A Substantial Sell-Off

Though the valuation of Altera at $8.75 billion appears to be a lower figure compared to the initial acquisition price, one cannot dismiss the hefty sum Intel will still net: approximately $4 billion for half the company is no small feat. It is essential to take these valuations in context; market dynamics and tech trends play substantial roles in determining worth. Today’s landscape, characterized by volatility and rapid innovation, often adjusts company valuations in unforeseen ways. Despite the reduction in valuation, Intel’s decision to retain 49% of Altera’s shares ensures they remain intricately involved in the company’s future developments—a strategic insurance policy to maintain influence and oversight.

A Firm with a Noteworthy Portfolio

Silver Lake, a seasoned player in tech investments, is well-known for its substantial financial prowess, boasting over $104 billion in investments. Its strategic investments include a mélange of technology and innovative software companies, not to mention sports franchises. This latest investment in Altera is poised to be one of Silver Lake’s larger undertakings in the tech domain, signaling their continued commitment to diversifying their portfolio with vast growth potential. The irony of Silver Lake’s name against Intel’s chip nomenclature, while purely coincidental, adds a layer of intrigue to their partnership.

As a firm that has previously invested in notable corporations such as Twitter and Airbnb, both receiving $1 billion each back in 2020, Silver Lake’s track record speaks volumes about its ability to identify and nurture competencies within high-potential companies. One can only imagine the strategic frameworks they might impose on Altera, possibly steering it toward fruitful innovation and expanded market reach.

The Leadership Change and the Path Ahead

Intel’s divestiture comes on the heels of a notable leadership change, with Raghib Hussain set to replace Sandra Rivera as the new CEO of Altera. This transition could serve as a catalyst for Altera to reinvent itself amid this new investment and management backdrop. The question remains, however: to what extent will Intel influence Altera post-transaction? Understanding the delicate balance of power within this newly independent relationship will be critical in shaping Altera’s trajectory as it operates as the largest technically independent company of its kind.

In an environment rife with competition and innovation, the question of how independent Altera truly becomes remains open-ended. The extent of Intel’s retained influence will be scrutinized in the coming months as Altera navigates its new identity and operational latitude under Silver Lake’s stewardship. This deal is more than mere financial arithmetic; it epitomizes a critical juncture where traditional power dynamics in tech are being redefined.

The unfolding narrative of Intel and Altera’s relationship, interlaced with Silver Lake’s strategic interests, presents a diverse array of possibilities for the semiconductor realm. Quite notably, the ripple effects of this deal could reshape how companies approach partnerships, acquisitions, and independent operations in an era defined by rapid technological advancements and market flux.