In a dynamic automotive and rental market, Hertz is making waves with its innovative approach to electric vehicle (EV) rentals. The company has recently reached out to several of its electric vehicle renters with enticing offers to purchase the very cars they have been using. This strategy not only highlights the growing consumer interest in EVs but also addresses a pressing need for rental companies to adapt to changing market demands. As electric vehicles become more mainstream, rental companies are looking for ways to engage customers beyond a temporary rental experience.

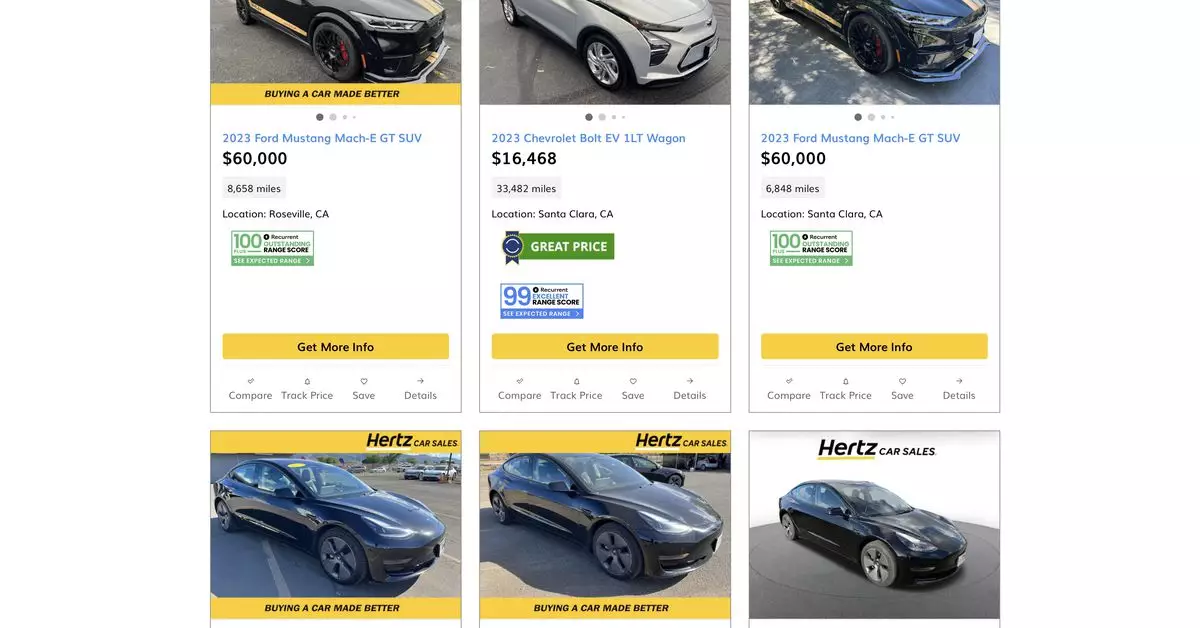

Reports indicate that renters have been presented with attractive buyout options for their vehicles. For instance, a recent 2023 Model 3 renter on Reddit mentioned an offer of $17,913 for their car, a rate comparable to listings on Hertz’s own car sales website. When evaluated against the vehicle’s usage—approximately 30,000 miles—it appears that these prices are beneficial not only for Hertz as they sell off vehicles but also for consumers who may be considering purchasing an EV. Such offers seem particularly compelling, especially compared to typical used car prices on the market.

Hertz’s strategy includes other models like the Chevy Bolt and the Polestar 2, with buyout offers ranging from $18,442 to $28,500, respectively. This pricing model offers prospective buyers a chance to own a vehicle with a limited warranty and a seven-day buyback option, providing consumers with confidence in their purchase.

However, Hertz’s journey towards a fleet primarily composed of electric vehicles has not been without its struggles. Initially, the company had ambitious plans to electrify its rental offerings; yet, last year’s indications of dwindling customer interest and maintenance challenges with models like the Model 3 necessitated a reassessment of these goals. Compounding these challenges was the decision in February to halt purchases of Polestar 2 vehicles, alongside plans to sell off a significant portion of their Tesla inventory.

This pivot reflects a broader trend within the automotive industry whereby companies must adapt to fluctuating consumer preferences and operational challenges. Hertz’s communication director, Jamie Line, clarified that these buyout offers stem from a broader strategy to inform customers about available sales opportunities while reminding them that Hertz is a seller of vehicles, not just a rental agency.

As rental companies like Hertz explore the nuances of consumer behavior and digital marketing strategies, it remains to be seen how successful these efforts will be for their long-term growth. The positive reception of buyout offers may lead to stronger customer loyalty and a shift in how people perceive rental services. Moreover, these developments could signify a turning point in the relationship between traditional rental businesses and the emerging electric vehicle market.

Ultimately, Hertz’s willingness to innovate in response to market demands illustrates a critical transition within the automotive rental industry. By embracing the evolving landscape of electric vehicles, firms not only pave the way for enhanced customer experiences but also contribute to the broader adoption of sustainable transportation options. The coming years will reveal the effectiveness of these strategies, shaping the future of both residential and commercial electric vehicle usage.